Red Hill Gold Resource Upgrade, Mill Expansion Progress & Development Assumptions Reiterated

DENVER, CO / ACCESS Newswire / May 22, 2025 / Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to share a significant exploration and development update for the Red Hill gold project in Western Australia ("Red Hill") from its royalty operating partner, Northern Star Resources Limited ("Northern Star"), released on May 15, 2025. Vox holds a 4.0% gross revenue royalty over mining lease M27/57 at Red Hill.

The Red Hill gold deposit is located 3.5km east of Northern Star's Kanowna Belle mine and processing plant and 22km north-east of Northern Star's Kalgoorlie Consolidated Gold Mines Operations ("KCGM"), which includes the Fimiston processing plant in Western Australia. KCGM and the Fimiston plant are currently undergoing a major brownfield expansion project (2) by Northern Star. The A$1.5 billion KCGM Mill Expansion Project is scheduled for commissioning in FY27 and expected to increase processing capacity from 13Mtpa to 27Mtpa. The Red Hill project was historically mined as an open pit operation between 2001 and 2007, producing approximately 467,000oz.

Spencer Cole, Chief Investment Officer stated: "This resource upgrade for the consolidated Kalgoorlie Operations, Fimiston mill expansion progress and permitting guidance from Northern Star reinforces Vox management confidence on the near-term Red Hill development pathway. We are encouraged that all required environmental studies and statutory government approvals are ongoing with a Mining Proposal and Mine Closure Plan expected to be submitted ahead of operations recommencing. With Northern Star planning to process Red Hill ore through its significantly expanded Fimiston mill-targeting 23Mtpa capacity in FY2027-Red Hill is clearly emerging as a priority satellite bulk-tonnage feed source within its Kalgoorlie Operations. The low-risk nature of the mineral resource, existing haul road access to Fimiston, and positive preliminary economic studies highlight why Northern Star are prioritizing this exciting gold deposit."

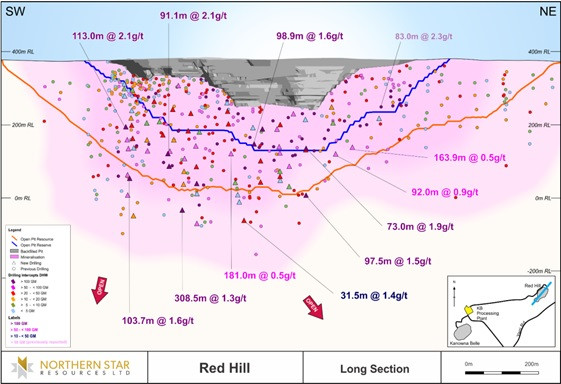

Figure 1. Red Hill Drilling & Open Pit Shells

(Source: Northern Star, 15 May 2025 Annual Mineral Resources and Ore Reserves Statement)

Significant Resource Estimate Upgrade (1)

On May 15, 2025, Northern Star announced the following:

Recent drilling at Red Hill has focused on upgrading the Inferred Mineral Resources to an Indicated classification to support Ore Reserve growth.

For the Kalgoorlie Operations, an increase in total ounces of 1.02Moz @ 1.4g/t Au Measured and Indicated (47Koz @ 1.9g/t Au Measured, 969Koz @ 1.4g/t Au Indicated) and 567Koz @ 1.5g/t Au Inferred, or 21%, in Mineral Resources and 0.3Moz @ 3g/t Au, or 19%, in Mineral Reserves (Probable), which included the following:

Maiden mineral resources and ore reserves at the Hercules deposit of 491Koz @ 2.1g/t Au Indicated, 425Koz @ 2.2g/t Au Inferred and 0.25Moz @ 3.1g/t Au (Probable), respectively (not royalty-linked); and

Resource growth of 525Koz @ 1.1g/t Au Measured and Indicated (47Koz @ 1.9g/t Au Measured, 478Koz @ 1.1g/t Au Indicated) and 142Koz @ 0.8g/t Au Inferred from multiple regional deposits (excluding Hercules) at the Kalgoorlie Operations, including the Red Hill royalty-linked deposit.

Mineral Resources were estimated at a gold price of A$3,000/oz and Ore Reserves estimated at a gold price of A$2,250/oz.

In the same announcement, the following commentary and detailed mining assumptions were included in Appendix C, Table 1:

Reporting of Exploration Results and Estimation of Mineral Resources:

"A previous iteration of the Red Hill Mineral Resource estimate was also sent for external peer review and risk analysis. This review found no fatal flaws and considered both the geological interpretation and Mineral Resource estimate to be low risk."

"Further drilling will continue to test the current resource area for bulk potential below the Red Hill pit during FY2025."

" The (resource) wireframe continues to an RL [Relative Level] of -350 m for targeting purposes. Mineral Resources are not reported below the -150 m RL due to lack of data below this depth "

Estimation and reporting of Ore Reserves:

"A gold price of A$2,250 per ounce has been used in the optimisation of the Red Hill Project."

"The Ore Reserve Estimation is based on detailed life of mine pit design and reflects positive economic outcomes."

"A minimum Pre-Feasibility level study is completed prior to converting an ore zone into ore Reserve."

"The selected mining method for the Red Hill deposit is a bench mining open pit method, mined using conventional open pit mining methods (drill, blast, load and haul) utilising 250t class excavators and 180t trucks."

"Ore from the project will be processed through the Fimiston Processing Plant at the KCGM operation, hence no processing infrastructure is required."

"Agreements are in place and are current with all key stakeholders including traditional landowner claimants."

"All required Environmental Studies and Statutory Government approvals including works approvals and clearing permit are ongoing. A Mining Proposal and Mine Closure Plan will be submitted at later stage in appropriate manner for the operation to recommence."

KCGM Mill Expansion Progress

On April 29, 2025, Northern Star announced the following update on the KCGM Mill Expansion Project in its Quarterly Activities Report:

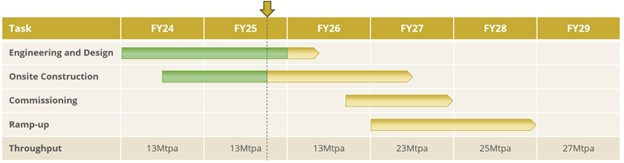

The KCGM Mill Expansion Project, centred on the Fimiston Processing Plant, is expected to replace 85% of the 13Mtpa plant, increase overall processing capacity to 27Mtpa and consolidate the Gidji facility. KCGM is expected to operate at ~900koz per annum from FY29 (steady state), following a two-year ramp-up (FY27-28) upon completion of the Mill Expansion.

KCGM Mill Expansion tracking to plan; transitioned from concreting into structural and mechanical installation.

FY25 KCGM Mill Expansion CAPEX remains unchanged at A$500-A$530 million.

Forecast free cash flow combined with cash on hand at Northern Star fully funds the Mill Expansion's A$1.5 billion capital expenditure budget.

The overall project progress timeline and expected throughput increase from 13Mtpa to 23Mtpa in FY27 (1-July-2026 to 30-June-2027) is shown below in Figure 2:

Figure 2. KCGM Mill Expansion Project Progress

(Source: Northern Star, 29 April 2025 Quarterly Report)

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties spanning six jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 30 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Spencer Cole | Kyle Floyd |

Chief Investment Officer | Chief Executive Officer |

[email protected] | [email protected] |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator updates provided by management and the potential impact on the Company of such operator updates, statements regarding expectations for the timing of commencement of development, construction at and/or resource production from the Red Hill project, expectations regarding the size, quality and exploitability of the resources at the Red Hill project, timing of the KCGM Mill Expansion Project, the expected increase to processing capacity as a result of the KCGM Mill Expansion Project, the expected timing for the Mining Proposal and Mine Closure Plan, future operations and work programs of Vox's mining operator partners, the receipt of expected and potential royalty payments derived from various royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox and requirements for and operator ability to receive regulatory approvals.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions, including international trade and tariffs; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty or stream payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox's dividend policy; epidemics, pandemics or other public health crises, including the global outbreak of the novel coronavirus, geopolitical events and other uncertainties, such as the changes to United States tariff and import/export regulations, as well as those factors discussed in the section entitled "Risk Factors" in Vox's annual information form for the financial year ended December 31, 2024 available at www.sedarplus.ca and the SEC's website at www.sec.gov (as part of Vox's Form 40-F).

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production from a property.

References & Notes:

Northern Star Resources Limited Annual Mineral Resources And Ore Reserves Statement dated May 15, 2025: https://www.nsrltd.com/media/dhrlgmbl/resources-reserves-and-exploration-update-15-05-2025.pdf

KCGM Mill Expansion Approved, Work Underway dated June 22, 2023: https://www.nsrltd.com/media/j5bljo10/kcgm-mill-expansion-financial-investment-decision.pdf

The most recently unconsolidated JORC-2012 mineral resource for the Red Hill deposit, prior to consolidation within Kalgoorlie Operations, was referenced in 2024 as 25.6Mt @ 1.2g/t Au for 1.0Moz Indicated and 24.2Mt @ 1.1g/t Au for 868Koz Inferred by Northern Star on 6 August 2024.

Based on Northern Star disclosure it is estimated that approximately 87.5% of Red Hill mineral reserves are covered by the royalty tenure M27/57. Vox management estimates that between 65% - 85% of mineral resources are covered by royalty tenure, based on Northern Star disclosure.

SOURCE: Vox Royalty Corp

View the original press release on ACCESS Newswire

J.Campbell--SMC

London

London

Manchester

Manchester

Glasgow

Glasgow

Dublin

Dublin

Belfast

Belfast

Washington

Washington

Denver

Denver

Atlanta

Atlanta

Dallas

Dallas

Houston Texas

Houston Texas

New Orleans

New Orleans

El Paso

El Paso

Phoenix

Phoenix

Los Angeles

Los Angeles