Tocvan Drills Broadest Silver Zone Ever at 100% Controlled Gran Pilar Drills 42.7 meters of 41 g/t Silver From Surface, Including 10.7 meters of 136 g/t (4.4 oz) Silver

Highlights:

RC Drill Results from 100% Controlled South Block Returns Significant Mineralization

42.7 meters of 41 g/t Silver and 0.14 g/t Gold, from surface (JES-25-120)

Includes 4.6 meters of 180 g/t Silver, from 38.1 meters downhole

The hole Stopped in mineralization at 42.7 meters due to intersection with void (artisanal mine shaft) from 33.6 to 38.1 meters downhole

Expands on High-Grade Gold Zone Seen in JES-24-101 (3.1m of 19.4 g/t Au; February 25, 2025)

Anomalous Gold and Silver Seen Across All Scout Drilling

CALGARY, AB / ACCESS Newswire / June 25, 2025 / Tocvan Ventures Corp. (the "Company") (CSE:TOC)(OTCQB:TCVNF)(WKN:TV3/A2PE64), is pleased to announce reverse circulation (RC) drill results from the latest drill program at the Gran Pilar Gold-Silver Project in mine-friendly Sonora, Mexico. Drilling is now focused on the 100% controlled expansion area, where recent scout drilling returned significant mineralization (see February 25, 2025 and May 7, 2025 News Releases). Today's results are highlighted by the broadest silver zone ever intersected at Gran Pilar, with 42.7 meters of 41 g/t silver from surface in hole JES-25-120, including a high-grade interval of 10.7 meters of 136 g/t silver (4.4 oz/t).

"These results mark a pivotal moment for Gran Pilar, with the broadest silver zone ever drilled on the project and continued success in expanding our 100% controlled South Block," said Brodie Sutherland, CEO of Tocvan Ventures. "The consistency of mineralization across all scout drilling and the presence of high-grade intervals underscore the tremendous potential of this area, positioning Gran Pilar favorably alongside established gold and silver producers in Sonora known for their high-grades and bulk-tonnage deposits. We are excited to continue unlocking the value of Gran Pilar as we move toward further exploration and development."

The Company notes there has been recent market volatility due to public comments from the Mexican Government related to mining. The Company does not view these comments as having a negative impact on operations and future development. All concessions controlled by Tocvan are in good standing and active. The Company does not foresee any delays related to its current permitting initiatives both for exploration drilling and the pilot test facility.

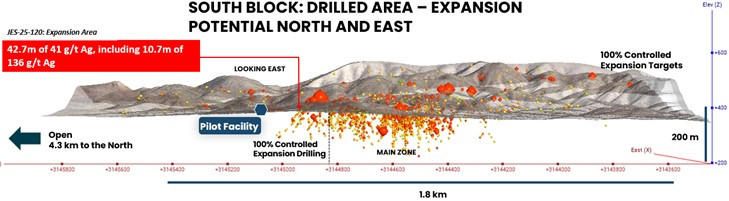

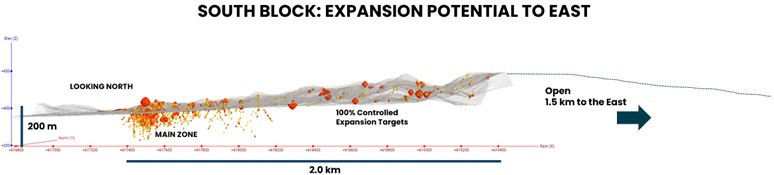

Figure 1. Target 3D map of the South Block area where drilling continues to expand resource potential. Undrilled target areas extend a kilometer north and 1.5 kilometers to the east with additional area to expand. Drilling has only tested the system 150m vertically so far. The South Block includes the area identified for a pilot facility. The North Block prospect (off map area) includes a 3.2 x 1.5 km alteration zone that remains untested with drilling.

Figure 2. Target 3D map of the South Block area where drilling continues to expand resource potential. Undrilled target areas extend a kilometer north and 1.5 kilometers to the east with additional area to expand.

Discussion of Results

Drillhole JES-25-120

This is the broadest silver zone ever intersected at Gran Pilar, indicating a robust near-surface silver-gold system. The high-grade silver interval (136 g/t over 10.7 meters) suggests localized enrichment, potentially associated with structurally controlled vein systems or breccia zones. The hole was terminated prematurely at 42.7 meters due to an artisanal mine shaft void (33.6 to 38.1 meters), implying that the mineralization likely extends deeper.

The near-surface nature of this intercept, beginning at surface, points to a potential oxidized zone where silver mineralization is concentrated. The presence of gold (0.14 g/t across the interval) further supports the multi-metal potential of the South Block.

The broad zone and high-grade subinterval suggest a significant silver resource could be delineated with further drilling, particularly to test continuity at depth and laterally. The void intersection highlights historical mining activity, which may guide future exploration toward high-grade targets exploited by artisanal miners. High amounts of copper were recorded immediately above the void (6.1m of 0.29% Cu). Below the void, anomalous lead (up to 0.12% Pb) and zinc (up to 0.15% Zn) were recorded, further outlining the potential for significant epithermal style mineralization.

The results build on the high-grade gold intercept reported earlier this year in JES-24-101 (3.1 meters of 19.4 g/t Au) and demonstrate the continuity of mineralization across the South Block. Hole JES-25-119, located 90 meters north of JES-25-120, further supports the expansion potential with 7.6 meters of 0.4 g/t Au and 12 g/t Ag. These results indicate that the South Block could host a significant extension of the known mineralized system at Gran Pilar.

Consistent Gold and Silver Mineralization Across All Holes

100% of drill holes reported gold mineralization (>0.1 g/t Au), with 21% exceeding 25 gram-meters (grade x width), comparable to the Main Zone Area (22% of holes). Notable intercepts include:

JES-25-119: 22.9 meters of 0.14 g/t Au and 5.4 g/t Ag, including 7.6 meters of 0.37 g/t Au and 12.4 g/t Ag, with a high-grade subinterval of 1.5 meters of 0.97 g/t Au and 32.8 g/t Ag.

JES-25-122: 12.2 meters of 0.14 g/t Au and 4.0 g/t Ag, including 4.6 meters of 0.34 g/t Au and 5.3 g/t Ag, with a peak of 1.5 meters of 0.88 g/t Au and 8.7 g/t Ag.

JES-25-123: Multiple shorter intercepts, including 1.5 meters of 0.25 g/t Au and 29.8 g/t Ag, indicating localized high-grade zones.

Extend the high-grade silver zone in JES-25-120 beyond the artisanal shaft.

Connect the mineralized zones between JES-25-119, JES-25-120, and other holes to define a resource.

Test deeper targets to explore the vertical extent of the system, particularly in areas with deeper intercepts like JES-25-123.

Conduct geophysical surveys (e.g., IP or magnetics) to map structural controls and identify additional targets.

The consistency of gold and silver mineralization across all holes underscores the widespread nature of the mineralized system in the South Block. The gram-meter metric highlights the presence of economically significant zones, with JES-25-119 and JES-25-122 showing continuity of mineralization over meaningful widths.

The results suggest a structurally controlled epithermal system with disseminated and vein-hosted gold and silver. The variation in grade and width across holes indicates potential for both bulk-tonnage and high-grade vein targets.

The 100% hit rate for gold mineralization mirrors the success seen in the Main Zone, suggesting the South Block could host a comparable resource. The presence of higher-grade subintervals (e.g., 0.97 g/t Au in JES-25-119) indicates potential for targeted high-grade zones within broader mineralized envelopes.

Depth and Lateral Continuity

Mineralization was intersected at various depths, from surface (JES-25-120, JES-25-121) to deeper levels (e.g., JES-25-119 at 94.6-102.2 meters; JES-25-123 at 166.2-176.9 meters). The distribution of mineralization at different depths and across a wide area suggests a large, potentially interconnected mineralized system. The deeper intercepts in JES-25-119 and JES-25-123 indicate that mineralization persists beyond near-surface oxidized zones, potentially transitioning into sulfide-rich zones typical of epithermal systems.

The spatial relationship between holes suggests a mineralized corridor that could be further defined with infill drilling. The presence of mineralization at depth in JES-25-123 (10.7 meters of 0.06 g/t Au and 1.8 g/t Ag) indicates the system has vertical extent, a key factor for resource potential.

The lateral and vertical extent of mineralization supports the potential for a scalable resource. Future drilling will focus on connecting these intercepts to define the geometry and continuity of the mineralized zone.

Comparison to Main Zone Area

The South Block shows a 100% hit rate for gold mineralization (>0.1 g/t Au) compared to 96% in the Main Zone Area, and 21% of holes exceed 25 gram-meters compared to 22% in the Main Zone.

These metrics indicate that the South Block is performing comparably to, or slightly better than, the more advanced Main Zone. The South Block's 100% ownership by Tocvan enhances its strategic value.

The South Block could represent a significant standalone asset or an extension of the Main Zone system, increasing the overall resource potential of Gran Pilar. The comparable metrics suggest that exploration strategies successful in the Main Zone (e.g., systematic drilling, geophysical targeting) could be effectively applied here.

Geological and Exploration Implications

The results are consistent with a low-sulfidation epithermal gold-silver system, characterized by broad zones of disseminated mineralization (e.g., JES-25-120) and localized high-grade veins (e.g., JES-25-119, JES-25-122). The presence of artisanal mine workings in JES-25-120 suggests historical recognition of high-grade surface mineralization, likely associated with quartz veins or breccias.

The variation in mineralization depth and grade suggests structural controls, such as faults or shear zones, which are typical hosts for epithermal deposits. The spatial distribution of intercepts indicates a northwest-southeast trending mineralized corridor, which should be a focus for future drilling.

Near-surface intercepts (e.g., JES-25-120, JES-25-121) likely represent oxidized zones where silver and gold are enriched due to supergene processes. Deeper intercepts (e.g., JES-25-119, JES-25-123) suggest a transition to primary sulfide mineralization, which could host higher gold grades at depth.

Resource Potential: The broad silver zone in JES-25-120 (42.7 meters of 41 g/t Ag) and consistent gold-silver intercepts across all holes suggest the South Block could host a significant resource. The high-grade subintervals (e.g., 136 g/t Ag, 0.97 g/t Au) indicate potential for economically attractive zones within a larger bulk-tonnage target.

Next Steps

Tocvan is planning additional drilling to further define the extent of the South Block mineralization, with a focus on testing deeper targets and expanding the footprint of high-grade zones. Metallurgical studies and permitting activities are ongoing to advance Gran Pilar toward development. Permitting for 47 drill pads and 67 trenches is underway, across the 100% controlled South & North Blocks. The Company will provide updates on future drilling and project milestones as they become available.

Exploration Strategy: The results justify an aggressive follow-up drilling program to:

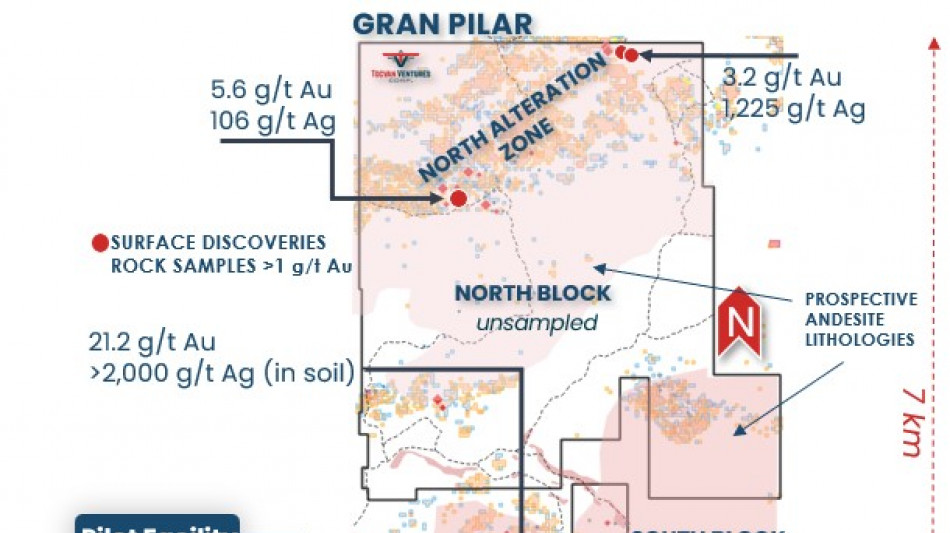

Figure 3. Gran Pilar Project Overview, > 22km2 of prospective ground with two primary targets: South Block, the direct extension and expansion of the historic Main Zone defined by an expanding vein field of untested drill targets; North Block a 3.2-km by 1.5-km pyrite and clay alteration zone that coincides with high-grade gold-silver, the area remains largely untested.

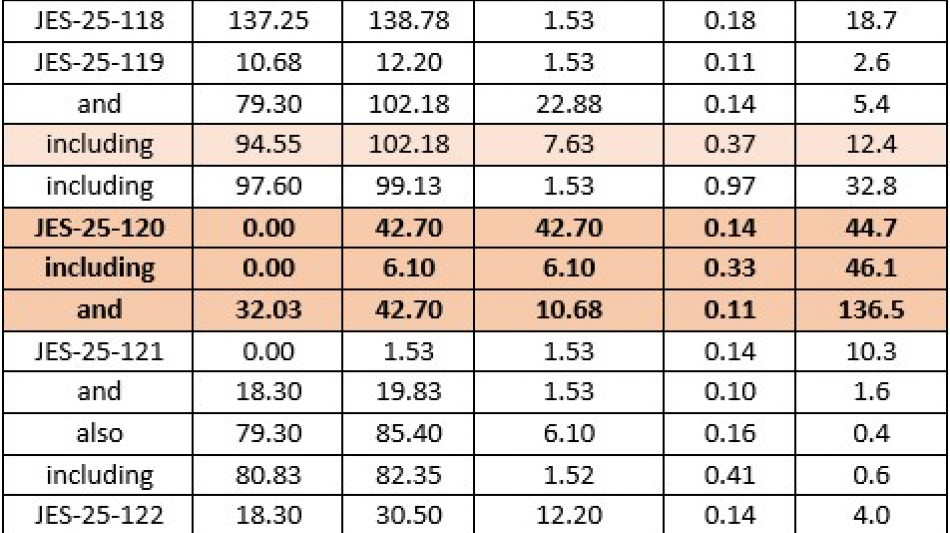

Table 1. Summary of Drill Results in today's release. Intervals reported are drilled lengths, currently there is insufficient information to determine true widths.

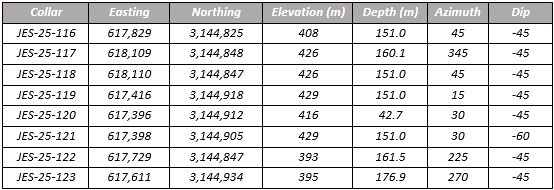

Table 2 Summary of drill collar locations and orientations. Coordinates are in UTM NAD 27, Zone 12N

Gran Pilar Drill Highlights (all lengths are drilled thicknesses):

2025 Diamond Drilling Highlights include:

83.5m @ 1.3 g/t Au, including 9.7m @ 10.3 g/t Au (March 11, 2025 News Release)

97.4m @ 0.7 g/t Au, including 36.3m @ 1.6 g/t Au (March 19, 2025 News Release)

64.9m @ 1.2 g/t Au, including 3.0m @ 21.6 g/t Au and 209 g/t Ag (March 26, 2025 News Release)

46.9m @ 0.5 g/t Au, including 2.6m @ 7.2 g/t Au and 80 g/t Ag (April 16, 2025 News Release)

2025 RC Drilling Highlights include:

106.8m @ 0.6 g/t Au, including 3.1m @ 19.4 g/t Au (February 25, 2025 News Release)

41.2m @ 1.0 g/t Au, including 6.1m @ 5.4 g/t Au (May 7, 2025 News Release)

2024 RC Drilling Highlights include:

42.7m @ 1.0 g/t Au, including 3.1m @ 10.9 g/t Au

56.4m @ 1.0 g/t Au, including 3.1m @ 14.7 g/t Au

16.8m @ 0.8 g/t Au and 19 g/t Ag

2022 Phase III Diamond Drilling Highlights include:

116.9m @ 1.2 g/t Au, including 10.2m @ 12 g/t Au and 23 g/t Ag

108.9m @ 0.8 g/t Au, including 9.4m @ 7.6 g/t Au and 5 g/t Ag

63.4m @ 0.6 g/t Au and 11 g/t Ag, including 29.9m @ 0.9 g/t Au and 18 g/t Ag

2021 Phase II RC Drilling Highlights include:

39.7m @ 1.0 g/t Au, including 1.5m @ 14.6 g/t Au

47.7m @ 0.7 g/t Au including 3m @ 5.6 g/t Au and 22 g/t Ag

29m @ 0.7 g/t Au

35.1m @ 0.7 g/t Au

2020 Phase I RC Drilling Highlights include:

94.6m @ 1.6 g/t Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

41.2m @ 1.1 g/t Au, including 3.1m @ 6.0 g/t Au and 12 g/t Ag ;

24.4m @ 2.5 g/t Au and 73 g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

15,000m of Historic Core & RC drilling. Highlights include:

61.0m @ 0.8 g/t Au

21.0m @ 38.3 g/t Au and 38 g/t Ag

13.0m @ 9.6 g/t Au

9.0m @ 10.2 g/t Au and 46 g/t Ag

Pilar Bulk Sample Summary:

62% Recovery of Gold Achieved Over 46-day Leaching Period

Head Grade Calculated at 1.9 g/t Au and 7 g/t Ag; Extracted Grade Calculated at 1.2 g/t Au and 3 g/t Ag

Bulk Sample Only Included Coarse Fraction of Material (+3/4" to +1/8")

Fine Fraction (-1/8") Indicates Rapid Recovery with Agitated Leach

Agitated Bottle Roll Test Returned Rapid and High Recovery Results: 80% Recovery of Gold and 94% Recovery of Silver after Rapid 24-hour Retention Time

Additional Metallurgical Studies:

Gravity Recovery with Agitated Leach Results of Five Composite Samples Returned

95 to 99% Recovery of Gold

73 to 97% Recovery of Silver

Includes the Recovery of 99% Au and 73% Ag from Drill Core Composite at 120-meter depth.

About Tocvan Ventures Corp.

Tocvan Ventures Corp. is a dynamic exploration and development company advancing high-potential gold and silver projects in the mine-friendly jurisdiction of Sonora, Mexico. At its flagship Gran Pilar Gold-Silver Project, Tocvan holds a 100% interest in over 21 km² of prospective ground, bolstered by the pivotal 2023 land acquisition that provides ample space for scalable mine infrastructure, including a planned 50,000-tonne pilot production facility. The Company also maintains a 51% interest in a 1 km² joint venture area with Colibri Resources, further expanding its footprint. Recent exploration successes, including near surface 3.1 meters at 19.4 g/t Au, underscore Gran Pilar's potential as a premier gold-silver asset. Additionally, Tocvan's 100% owned Picacho Gold-Silver Project, located in the prolific Caborca Trend-home to some of Mexico's largest gold deposits-positions the Company for further growth. With robust metallurgical results (up to 99% gold and 97% silver recovery) and a strategic capital to bolster growth, Tocvan is poised to deliver significant shareholder value in a market buoyed by record-high gold prices. With approximately 59 million shares outstanding, Tocvan is committed to unlocking the full potential of its assets through innovative exploration, strategic development, and investor-focused initiatives.

Quality Assurance / Quality Control

Rock and Drill samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold was analyzed using 50-gram nominal weight fire assay with atomic absorption spectroscopy finish. Over limits for gold (>10 g/t), were analyzed using fire assay with a gravimetric finish. Silver and other elements were analyzed using a four-acid digestion with an ICP finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's robust quality assurance / quality control protocol. Samples are securely packaged and transported to the lab by company staff.

Soil Samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold and multi-element analysis of soils was completed by aqua regia digestion and ICP-MS finish using a 50-gram nominal weight. Over limit gold values greater than 1 g/t were re-assayed with a more robust aqua regia digestion ad ICP-MS finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising blank samples and certified reference materials were systematically inserted into the sample stream and analyzed as part of the Company's robust quality assurance / quality control protocol.

Brodie A. Sutherland, CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Cautionary Statement Regarding Forward Looking Statements

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the

Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company's business, the Company's formative stage of development and the Company's financial position. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws.

There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

For more information, please contact:

TOCVAN VENTURES CORP.

Brodie A. Sutherland, CEO

1150, 707 - 7 Ave SW

Calgary, Alberta T2P 3H6

Telephone: 1-888-772-2452

Email: [email protected]

STAY CONNECTED:

LinkedIn: TOC LinkedIn

X: TOC X

Facebook: TOC Facebook

YouTube: TOC YouTube

Web: tocvan.com

Latest Webinar: May 2, 2025 Company Update

SOURCE: Tocvan Ventures Corp

View the original press release on ACCESS Newswire

M.Johnston--SMC

London

London

Manchester

Manchester

Glasgow

Glasgow

Dublin

Dublin

Belfast

Belfast

Washington

Washington

Denver

Denver

Atlanta

Atlanta

Dallas

Dallas

Houston Texas

Houston Texas

New Orleans

New Orleans

El Paso

El Paso

Phoenix

Phoenix

Los Angeles

Los Angeles